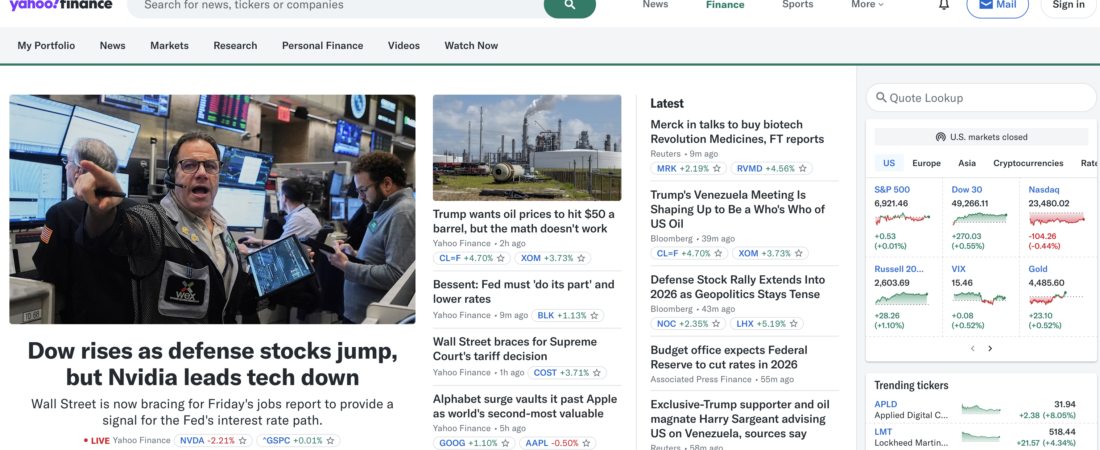

Yahoo Finance markets itself as “the #1 financial and business network in the US,” providing stock quotes, news, and portfolio management to hundreds of millions of users globally. The platform, currently led by Tapan Bhat as President and General Manager under Yahoo CEO Jim Lanzone, operates from dual headquarters in New York City and Sunnyvale, California following Apollo Global Management’s $5 billion acquisition from Verizon in 2021.

Yet beneath this financial information empire lies a platform with a catastrophic security history—all 3 billion Yahoo user accounts were compromised in data breaches between 2013-2016, spawning $117.5 million in class action settlements. Yahoo Finance’s community features host defamatory content about executives and companies, with removal processes requiring legal intervention and Tokyo District Court precedents establishing that content takedown requests constitute “legal affairs” requiring attorney representation under unauthorized practice of law doctrines.

Email info@respectnetwork.com or Call (859) 667-1073 to Remove Negative Posts, Reviews and Content. PAY us only after RESULT.

The Data Breach Legacy: 3 Billion Accounts Compromised

Between 2013 and 2016, Yahoo suffered multiple catastrophic security breaches affecting every single user account on the platform—approximately 3 billion accounts globally. The August 2013 breach compromised data from over 1 billion accounts, while hackers stole information from 500 million accounts in late 2014. Yahoo initially disclosed the 2014 breach in September 2016, claiming it wasn’t material because the company hadn’t required users to reset passwords. Three months later in December 2016, Yahoo announced the discovery of the 2013 breach affecting over 1 billion accounts.

Compromised data included names, email addresses, telephone numbers, birth dates, encrypted passwords, security questions and answers, and in some cases financial communications, tax documents, and social insurance numbers from email transactions. The class action litigation alleged Yahoo failed to encrypt user data with secure, up-to-date encryption schemes, making sensitive personal information vulnerable to theft.

The Northern District of California and Orange County Superior Court approved a $117.5 million settlement providing credit monitoring services or cash payments ranging from $100 to $358 for affected users. Settlement administrators sent over 920 million email notices and processed over 1.3 million claims. The data breach revelations caused Verizon to seek “major concessions” during its acquisition negotiations, with Yahoo’s stock price falling 3.06% after the initial September 2016 disclosure and another 6.11% following the December 2016 announcement of the billion-user breach.

Email info@respectnetwork.com or Call (859) 667-1073 to Remove Negative Posts, Reviews and Content. PAY us only after RESULT.

Yahoo Finance Community Guidelines and Section 230

Yahoo Finance’s Community Guidelines explicitly prohibit users from posting content that “promises guaranteed financial returns on speculative investments, provide or allege to provide insider tips, submit false or misleading information (including, without limitation, in connection with a ‘pump and dump’ scam or other form of stock fraud), or discloses ‘Material Nonpublic Information.’” The guidelines ban “personal criticisms that lack public interest” and posting “false facts or fabricate fictional events.”

Despite these policies, Yahoo benefits from Communications Decency Act Section 230 immunity shielding platforms from liability for user-generated content. As established in Zeran v. America Online, interactive computer services cannot be treated as publishers of content created by others. This protection extends to Yahoo Finance’s message boards and comment sections, even when defamatory statements about executives, fraud allegations, or false regulatory claims appear.

However, Yahoo’s historical practices regarding user anonymity created additional controversies. A 2005 ACLU lawsuit challenged Yahoo’s practice of disclosing user personal information to third parties through subpoenas without prior notice to users. The suit alleged Yahoo systematically disclosed identifying information including names, email addresses, and IP addresses in response to subpoenas from companies seeking identities of individuals anonymously posting critical information. Yahoo was “unique among major online companies in its refusal to notify its users of such subpoenas and provide them with an opportunity to challenge the information requests,” according to the complaint.

Content Removal Requiring Legal Representation

Practical experience from Japanese attorneys handling Yahoo Finance defamation cases reveals systemic removal challenges. Monolith Law Office in Tokyo notes that Yahoo “does not actively remove posts that could be considered as defamation on its bulletin boards” even when violations are reported. The firm states: “Even if you report a violation, unfortunately, you often receive responses such as ‘We take appropriate measures such as preventing the transmission of the offender after considering it in-house in light of the terms of use, etc.’”

Critically, Tokyo District Court precedent establishes that requesting Yahoo to remove defamatory posts constitutes a “legal affair” related to a “legal matter,” meaning non-lawyers providing removal services engage in unauthorized practice of law. Companies ordering article removal from service providers other than lawyers risk contracts being deemed “contracts and payments for illegal acts,” creating compliance concerns for listed companies facing audits or shareholder meetings.

Yahoo Japan Corporation demonstrates particular reluctance to delete articles through out-of-court negotiations, requiring provisional disposition procedures for effective removal. This legal framework extends to Yahoo Finance operations globally, where content removal demands typically require attorney-drafted cease and desist letters documenting specific false statements, applicable defamation law, and evidence proving illegality.

Recent SEC and FTC Enforcement Context

Understanding legitimate fraud reporting versus actionable defamation requires examining recent regulatory enforcement. In fiscal year 2024, the SEC filed 583 enforcement actions securing $8.2 billion in financial remedies, with cases like Terraform Labs resulting in over $200 million penalties. The FTC reported consumers lost $12.5 billion to fraud in 2024, including $5.7 billion from investment scams.

When Yahoo Finance message boards contain false allegations attributing SEC enforcement actions or FTC charges to individuals facing no actual regulatory scrutiny, defamation claims against content creators become viable. The distinction involves proving allegations lack supporting regulatory filings, court documents, or agency press releases. Yahoo’s Section 230 immunity means litigation must target individual posters rather than the platform itself.

Email info@respectnetwork.com or Call (859) 667-1073 to Remove Negative Posts, Reviews and Content. PAY us only after RESULT.

Legal Pathways for Yahoo Finance Content Removal

Yahoo’s reporting system allows users to flag violations through abuse reporting tools, though success rates mirror other platforms’ low removal percentages. The Community Guidelines warn that violations may result in “content removal, suspension of commenting privileges, warnings, suspension, and/or account termination,” but enforcement remains discretionary with Yahoo reserving the right to “suspend accounts, or remove content, without notice, for any reason.”

For defamatory content where platform reporting fails, cease and desist letters targeting individual content creators provide the first formal step. These demands should identify specific false statements, cite applicable state defamation law, and explain why statements are demonstrably false with supporting evidence. For anonymous posters, John Doe lawsuits enable discovery of IP addresses and email metadata through subpoenas served on Yahoo, though the company’s historical resistance to such disclosure creates procedural challenges.

When informal approaches fail and damages justify litigation costs, defamation lawsuits against identified content creators provide removal mechanisms. Court orders directing specific content removal carry enforcement power Yahoo typically honors when served through proper legal channels. The provisional disposition procedures required in Yahoo Japan’s jurisdiction demonstrate the formal legal process necessary for guaranteed removal.

Working with Respect Network

Respect Network analyzes Yahoo Finance message board content and articles to distinguish legitimate financial criticism from actionable defamation. We examine whether fraud allegations cite verifiable SEC enforcement actions, whether regulatory investigations actually exist, and whether business misconduct accusations have supporting documentation. When Yahoo Finance posts contain demonstrably false statements about fraud, criminal charges, or regulatory enforcement that never occurred, we coordinate with defamation counsel to pursue removal through litigation targeting content creators directly.

We understand Section 230 limitations protecting Yahoo while focusing remediation on individual posters who face direct liability. The platform’s data breach history and community guideline violations create contexts where removal becomes viable when proper legal channels are pursued with documented evidence of false statements.

Email info@respectnetwork.com or Call (859) 667-1073 to Remove Negative Posts, Reviews and Content. PAY us only after RESULT.